Your Guide to the Home Possible ® Mortgage

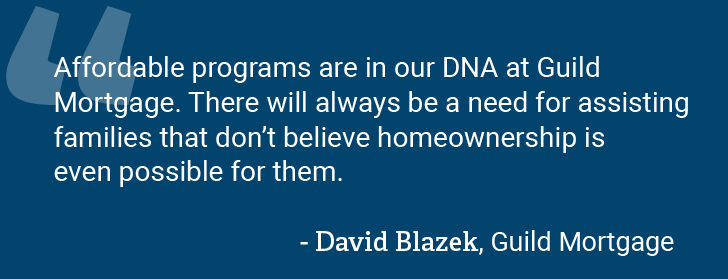

Empower borrowers to make informed decisions for responsible homeownership by eliminating a common barrier with a down payment as low as 3%.

The Freddie Mac Home Possible ® mortgage offers more options and credit flexibilities than ever before to help very low- to-low-income borrowers attain the dream of owning a home. Take a look…

Explore Home Possible ®

Explore the benefits of choosing a Home Possible ® mortgage.

- Allow for flexible sources of funding for down payment and combinable with many other types of down payment assistance.

- Apply sweat equity for up to the entire amount of the down payment and closing costs by applying construction skills for necessary improvements.

- Provide qualified, very low- to low-income borrowers, and those who live within low income census tracts, a maximum financing option with maximum flexibility.

- Enable the dream of home, whatever it may look like; single-family, manufactured housing or condominium.

- Cancel mortgage insurance upon reaching 20 percent equity, reducing the monthly mortgage payment, and potentially saving thousands over the life of the loan.

- Enable empowered decisions and life-long responsible homeownership with required financial literacy education, which can be fulfilled by Freddie Mac’s online, free CreditSmart ® Homebuyer U tutorial.

Make Home Possible ®

Let’s Get Started

Getting started with a Home Possible mortgage is easy!

Find videos and other materials for all your Home Possible ® training and education needs.

- Home Possible ® Mortgage Factsheet

- Home Possible ® Income Eligibility Training – for Freddie Mac Seller and Servicer Clients

- Home Possible ® Mortgage: Discover the Possibilities

- Loan Product Advisor ®

If you’re a lender, real estate or housing professional, we invite you to join us at industry conferences, workshops, and events.

Check for Eligibility

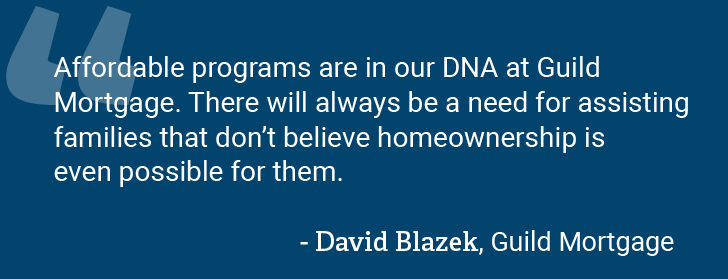

The Freddie Mac Home Possible ® mortgage offers outstanding flexibility to fit a variety of borrower situations. With Home Possible, we’re all for helping you capitalize on opportunities to meet the financing needs of very low- to low-income borrowers looking for low down payment options and flexible sources of funds. Use the resources below to check your borrower and location eligibility.

- Home Possible ® Income and Eligibility Tool

- Home Possible ® Mortgage Requirements

Already a Home Possible Pro?

The RISE (Recognizing Individuals for Sustained Excellence) Awards showcase top Home Possible ® mortgage producers who are committed to making homeownership a reality for very low- to low-income borrowers.

Award winners represent national and local lending companies, as well as their standout loan originators who are committed to making responsible and sustainable homeownership a reality.

Related Links

- Home Possible ® Cost Benefit

- Very Low-Income Purchase (VLIP) Mortgage Credit FAQ

- DPA One ®

- DPA One Case Study

- Home Possible ® Sweat Equity

- Low Down Payment Solutions: Home Possible ® and HomeOne ® Webinar

- Nicholas Whiteside Homeownership Story Promotion

- Home Possible ® Refinance Transactions Tutorial

- Home Possible ® Mortgage

- Home Possible ® FAQ

- Home Possible ® Income and Property Eligibility Tool

- Home Possible ® Mortgage Factsheet

- Home Possible ® Mortgage Requirements in Seller/Servicer Guide

- Home Possible ® Income Eligibility Tutorial

- Home Possible RISE Awards ®

- Discover the Possibilities of Home Possible ®

- Home Possible ® Mortgage Overview Training

- Increasing Homeownership in Underserved Communities with Cindy Waldron

- Low-Income Refinance Partner Toolkit

- Single-Family Refinance