The term “present value” refers to the application of the time value of money that discounts the future cash flow to arrive at its present-day value. We determine the discounting rate for the present value based on the current market return.

The formula for present value can be derived by discounting the future cash flow using a pre-specified rate (discount rate) and a number of years.

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

The formula For PV is given below:

PV = CF / (1 + r) tIn case of multiple compounding per year (denoted by n), the formula for PV can be expanded as,

PV = CF / (1 + r/n) t*nLet’s take an example to understand the Present Value’s calculation better.

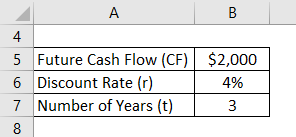

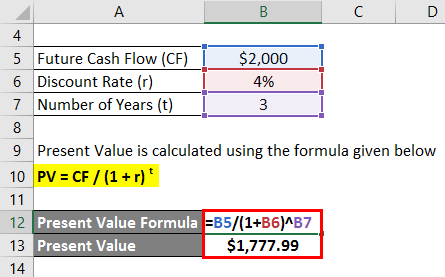

Let us take a simple example of a $2,000 future cash flow to be received after 3 years. According to the current market trend, the applicable discount rate is 4%. Calculate the value of the future cash flow today.

Solution:

We calculate the present value using the following formula:

PV = CF / (1 + r) t

Therefore, the $2,000 cash flow received after 3 years is worth $1,777.99 today.

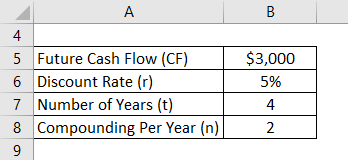

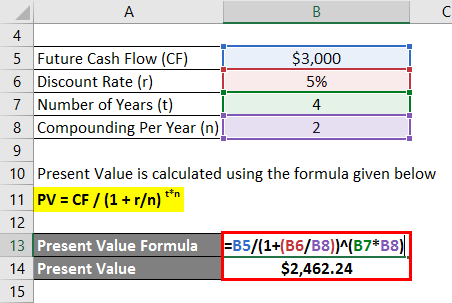

Let us take the example of David, who seeks a certain amount of money today such that after 4 years, he can withdraw $3,000. The applicable discount rate is 5%, to be compounded half-yearly. Calculate the amount that David is required to deposit today.

Solution:

Calculate the present value using the following formula:

PV = CF / (1 + r/n) t*n

Therefore, David needs to deposit $2,462 today in order to be able to withdraw $3,000 after 4 years.

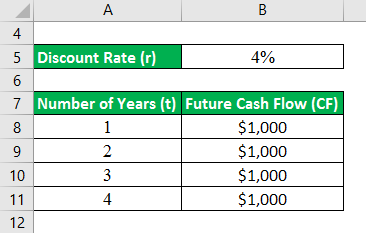

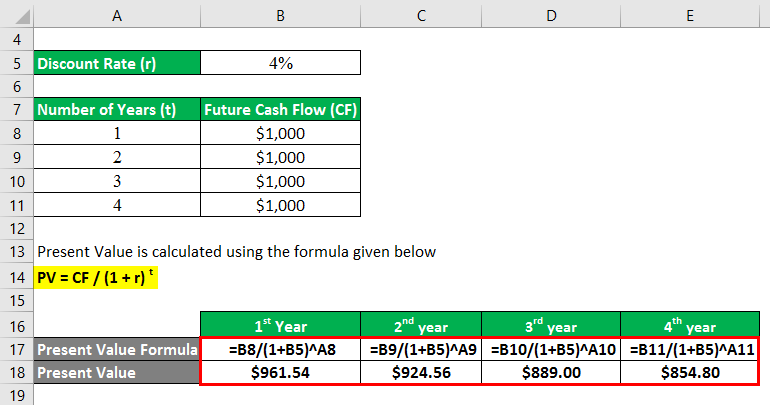

Let us take another example of John, who won a lottery, and as per its terms, he is eligible for a yearly cash pay-out of $1,000 for the next 4 years. The discount rate is 4%. Calculate the present value of all the future cash flows starting from the end of the current year.

Solution:

Calculate the present value using the following formula:

PV = CF / (1 + r) t

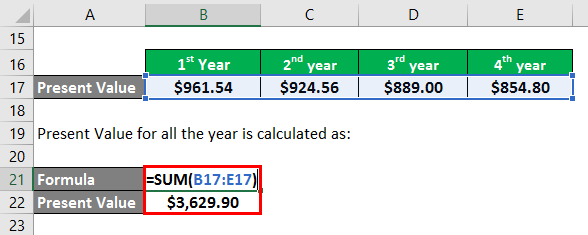

To calculate the present value for a particular year, use the following formula:

Therefore, John’sresent-day value of John’s lottery winning is $3,629.90.

The formula for the present value can be derived by using the following steps:

Step 1: Firstly, figure out the future cash flow which CF denotes.

Step 2: Decide the discounting rate based on the current market return. The rate, denoted by r, is what discounts the future cash flows.

Step 3: Next, determine the number of years until the future cash flow starts, denoted by t.

Step 4: You can derive the formula for present value by first discounting the future cash flow (step 1), then using a discount rate (step 2), and finally determining the number of years (step 3), as demonstrated below.

PV = CF / (1 + r) t

Step 5: If you know the number of compounding periods per year (n), you can express the formula for present value as follows:

PV = CF / (1 + r/n) t*n

The concept of present value is primarily based on the time value of money, which states that a dollar today is worth more than a dollar in the future. The present value calculation has a limitation in assuming a consistent rate of return throughout the entire time period. It is important to note that no investment can guarantee a specific rate of return, as various market factors can negatively impact the rate of return, leading to the potential erosion of the present value. As such, the assumption of an appropriate discount rate is all the more important for the correct valuation of future cash flows.

You can use the following Present Value Calculator “[wbcr_”nippet Articles

This is a guide to Present Value Formula. Here we have discussed How to Calculate Present Value along with practical examples. We also provide a Present Value Calculator with a downloadable Excel template. You may also look at the following articles to learn more –

1207+ Hours of HD Videos

15+ Learning Paths

100+ Courses

40+ Projects

Verifiable Certificate of Completion

Lifetime Access

6133+ Hours of HD Videos

40+ Learning Paths

750+ Courses

40+ Projects

Verifiable Certificate of Completion

Lifetime Access

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates

4655+ Hours of HD Videos

80+ Learning Paths

470+ Courses

50+ Projects

Verifiable Certificate of Completion

Lifetime Access

7286+ Hours of HD Videos

150+ Learning Paths

990+ Courses

50+ Projects

Verifiable Certificate of Completion

Lifetime Access

all.in.one: FINANCE - 750+ Courses | 6133+ Hrs | 40+ Specializations | Tests | Certificates 6133+ Hours of HD Videos | 40+ Learning Paths | 750+ Courses | 40+ Projects | Verifiable Certificate of Completion | Lifetime Access

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates 4655+ Hours of HD Videos | 80+ Learning Paths | 470+ Courses | 50+ Projects | Verifiable Certificate of Completion | Lifetime Access